Billionaires' Secrets You Must Have To Know

You don't usually get to one billion dollars and still own 100% of your business.

1. You don't usually get to one billion dollars and still own 100% of your business.

Jeff Bezos owns 12.7% of Amazon, Elon Musk owns 13% of Tesla, Bernard Arno owns 46% of LVMH, Warren Buffett owns 16% of Berkshire Hathaway, and Larry Allison owns 35% of Oracle. You get the idea; most millionaires are share protective.

They guard their shares like Hawks without realizing they're keeping themselves from accelerating upwards in a shorter period. Here's a wake-up call, owning 15% of a multi-billion dollar pie is much more financially lucrative than owning 100% of your three-million-dollar business.

2. Real estate will make you a millionaire, and Private Equity will make you a billionaire.

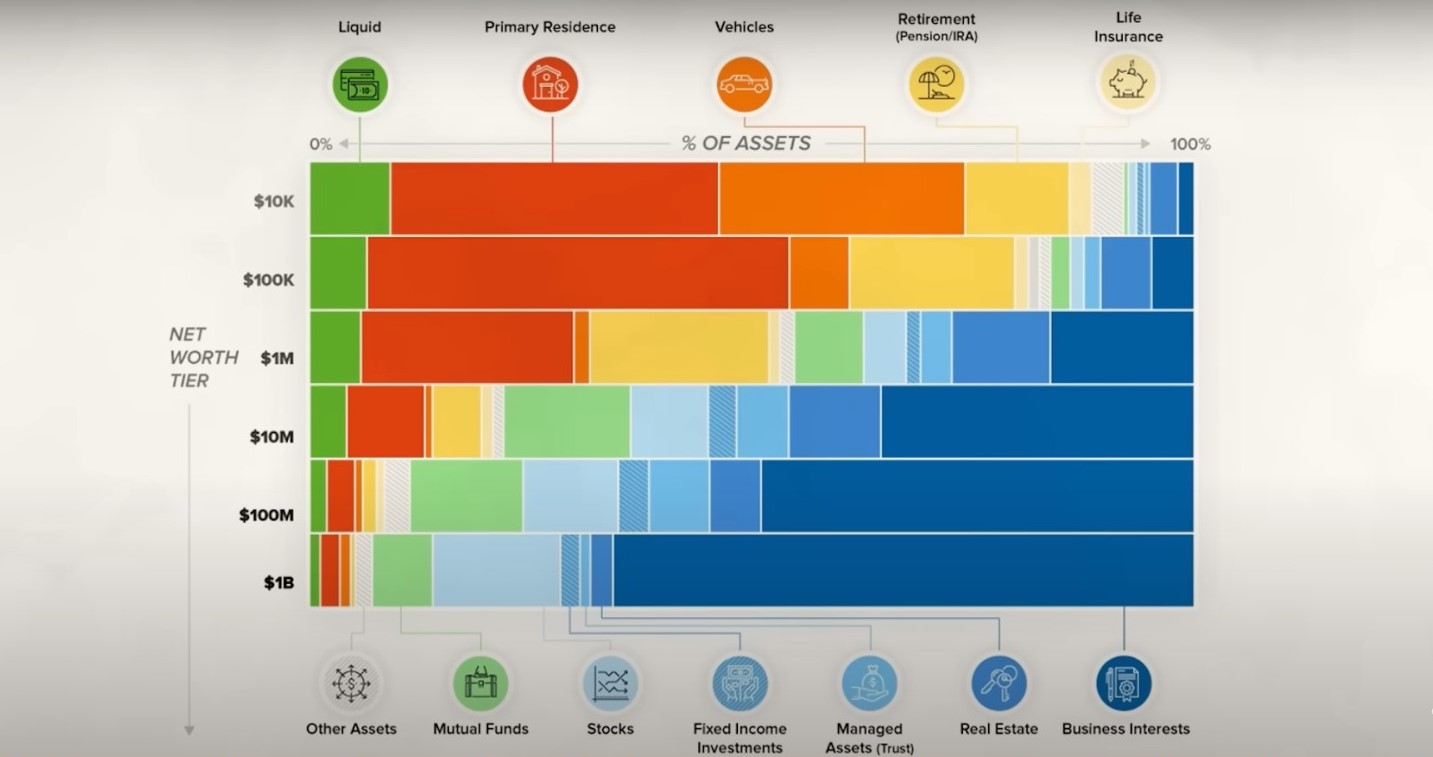

The running joke around the ultra-wealthy is that real estate is the dumb millionaires' game. You can become a millionaire in real estate. Even if you don't have the brain power to do anything else. Ask any millionaire, and they'll tell you almost half of 35 to 50% of their net worth is tied up in the real estate. Ask any billionaire, and you'll quickly realize business interests. Private equity makes up over 70% of their network. The most productive way to increase your net worth is by owning a business, Below it up, and then using the funds to buy pieces of other companies and do it all over again.

3. Do not use your own money, use someone else's to make yourself rich.

You can literally earn your way to one million dollars. There are plenty of jobs out there where if you put your head down, put in the years', and stack those checks, you'll get to seven figures. Doctors, lawyers, tech engineers, they all earn a ton of money from their salaries, but you cannot get to one billion dollars the same way.

Your financial life unlocks vertically, when you realise, you can use other people's money to make yourself rich. Here's how most billionaires, do it?

Step one, they go to friends, family banks, and angel investors with an idea that they're willing to go all the way to make it happen. They need $100,000 to start the business and give off 20% of the company. This values the company at $500,000. They're 80% share of this new business is worth $400,000 and we barely started.

Step two, they get some revenue and they build a team ready to scale. Let's say the company at this point is making one million dollars in recurring revenue per year.

Step three, they then go to some external investors and sell 20% of the business and a 10 million dollar valuation. Meaning they now have two million dollars in cash in the remaining 60% of the company is now worth six million dollars.

Step four, use that two million dollars to go from one to ten million dollars in yearly recurring revenue.

Step five, you go to raise funds again. This time at a hundred million dollar valuation, You sell 20% more of the business to get that 20 million dollars. At this point, the 40% you're left with is worth 40 million dollars.

Step six, you use the 20 million dollars to develop a product for other companies and hire salespeople. This blows up your recurring revenue, and in two short years, your company will be ready to go public.

Step seven, you file for an IPO where the company floats 10% of its shares on the public market at a 10 billion dollar valuation. You and everyone that's invested in your company. Along the way is now a billionaire. At every stage of this journey, you used other people's money to scale up to hire people, develop products, and get new sales. And with every one of those moves, the valuation went up.

4. Everything is a buy-low-cell high equation, only the scale differs.

Some billionaires trade in commodities, coffee, medals, etc. Others trade in shipping those commodities where the cost of gas, people, and transport is lower than what others are willing to pay you to get it delivered. Others trade in risk, in debt, Tech and media companies trade in attention and eyeballs. Buy them low, sell them high, use the profit to do it larger over and over again. Once you understand that, every business is in the buy-low-sell high business, the way you look at yours starts to change.

5. Art is a preferred store value that can easily be moved around.

When you're that rich, most of your money is locked up in stocks, other businesses, or hard-to-move assets. You don't want to keep it in cash because, at that scale, money is losing 5% to 10% of its value year-over-year due to inflation. So where do high net-worth individuals turn to? Art, yes, they buy art in bulk, lease it off to museums around the world, seal it off shipping containers, and use it as a bargaining chip. It's much easier to move 500 million dollars in art than 500 million dollars in gold or silver.

Most people don't realize that blue chip art is one of the most profitable investments. Fine art is often considered a billionaire asset for a good reason. Masterworks is a platform that allows everyday people to invest in multi-million dollar paintings for just a fraction of the price. Instead of buying the entire painting, you can invest in shares of it. And once that painting is sold, the shareowners split the profits. Those profits have been pretty impressive.

6. Stocks won't get you to a billion and neither will luck.

Stocks work well when you have a significant time horizon and a ton of money. Back in the 80s and 90s, there was this trend of financial advice, where they said, if you simply invested $5 every day in the stock market, starting when you were 20 years old and kept doing it until you were 65, you would be a millionaire. The math checks out, but the market and our costs are also evolving. These financial models tell a fancy tale; that's all surface. And we think they do more harm than good. And here's what we mean by that. Warren Buffett paid 31,500 dollars for his house back in 1958. Adjusted for inflation and market value, that house costs around 877,000 dollars today.

60 years later, that house costs 28.3 times more. It's the same house, lovely and old didn't grow any new bedrooms. Take a moment to process this. The place, just by doing nothing, has almost matched the performance of professional investors. If you save five dollars a day by the time you get to your million-dollar retirement, a million will barely buy you anything. It's the same with luck. You might luck your way into becoming a millionaire but going from that million to a billion is a different ballgame.

7. Every new billionaire turns other millionaires into billionaires.

Every newly minted billionaire brings those who believe in their vision enough to open their wallets in the early days. Peter Thiel was the first outside investor to back Facebook. He invested $500,000 in exchange for 10.2% of the company. When Facebook IPO'd, he sold two-thirds of his shares for 628 million dollars after investing 500,000. A friend of the channel, Gary Tan, the current CEO of Y Combinator, was the first investor in Coinbase in 2013. That initial investment of only $300,000 was worth 2.4 billion dollars. Go anywhere in Silicon Valley, and these types of stories always pop up. Make your money first and then use it to back promising businesses. One of them might just be the next Airbnb.

8. Less than 5% of their worth is liquid.

Ordinary people think the rich are hoarding resources. When they say billionaires, they picture Scrooge McDuck jumping into a volt filled with gold coins. But in reality, almost all of them are paper billionaires, Meaning shares they own in companies are worth more than one billion dollars. On paper, the assets are worth as much. Usually, billionaires keep less than five percent of their worth liquid. And if they do need money, they do not sell their assets. Instead, they go to banks. Show them the paper that says they're worth x amount and then use that as collateral for low-interest loans. The bank provides them with a line of credit, and they buy even more income, generating assets.

Most billionaires know, 'You do not pay tax on debt,' So they would instead borrow that money using their assets as collateral.

9. Real money is made in a crisis.

Billionaires look at the world differently than most people. Poor people look at life in terms of days, the middle class in terms of months, the upper class in terms of quarters, the rich in terms of years, and the super-rich in terms of decades. People criticized Warren Buffett's Berkshire Hathaway for underperforming for the past 10 years and critiqued his prominent cash position. Lost its value due to inflation, but Warren and Monger were just sitting on cash waiting.

They were okay with losing 1 to 3% per year because they could purchase companies at 50 to 75% discounts when this recession hit. For billionaires, recessions are like the Black Friday event of the decade, everything you really want is on sale, and that's one of their secrets; it's not the day-to-day you focus on. Instead, you make two to three plays per decade, which are strategic for growth.

10. They all had and still have experts, minimizing risk and increasing returns.

To have the time and mental space to focus on exponential growth, you must know that almost everything else is taken care of. You find significant accounting firms to mitigate all financial risks. You find substantial legal firms to reduce all liabilities, and great managers and CEOs steadily take the company to the next level.

Along the way, you must rely on and trust other people's expertise to get you to the next level. All these billionaires surround themselves with experts who can pinpoint precisely the inflection points and how to position themselves for them. These people are called executive coaches; every big CEO has some on the council.

At this level, they cost a few hundred thousand to a couple of million dollars annually. Their job is to keep the CEO focused and provide clarity of thought. Think how quickly would your life improve and how quickly would you crush your goals?

This is what the average billionaire investor's portfolio looks like.

Here's what you need to remember, you survive by earning! You get rich by owning!