Diversify Your Investment

Don't put all your eggs in one basket; diversify your investment.

Don't put all your eggs in one basket; diversify your investment.

Diversified Fund

In diversified equity funds, some schemes diversify among sectors based on the market capitalization of stocks. And the schemes invest across diverse sectors.

What is a Diversified Fund?

A Diversified Equity fund is a mutual fund category that invests in companies' stocks across many sectors and sizes. A diversified fund ensures that the poor performance of a particular industry or supply does not impact the entire portfolio.

A Fund can diversify by investing in the following:

▶ Many Sectors: A Diversified Fund can invest in various sectors like banking, chemicals, pharmaceuticals, FMCG, automobiles, etc.

▶ Many sizes: A fund can also diversify based on market capitalization, viz large caps having colossal market capitalization, mid caps with medium capitalizations, or small caps with small market capitalizations,

A diversified equity fund invests in companies regardless of size and sector. It diversifies investments across the stock market to maximize gains for investors.

Why Should You Invest in a Diversified Fund?

▶ Since the portfolio of a diversified equity scheme invests across many sectors. The poor performance of one sector is offset by the superior returns generated by other sectors.

▶ Since Diversified schemes can invest in many sectors. The fund manager can shift funds from non-performing sectors to performing ones.

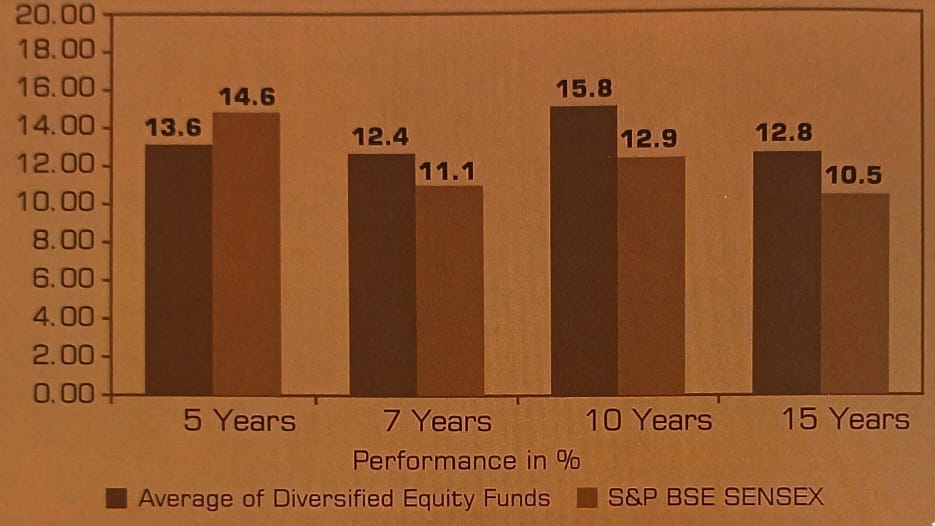

Performance: