The Best Mutual Fund Guide for Beginners

How much only we can see on TV that mutual funds are correct.

How much only we can see on TV that mutual funds are correct. Still, there is fear in my mind. What If I make a loss, are they showing the truth in the ads? Many doubts are there, why did this happen? Because many of us are not aware of mutual funds, and how it works.

The biggest fear in people is that if they make a loss in mutual funds I lose my money. So here I tell you, there are probably 300, 400, 500 schemes in the market. If you pick the worst scheme, you have a very bad advisor and he told you the worst scheme. 99% chance that if you stay invested for more than 7-8 years, then your return will be more than FD. You will get a 9%-10% return, even if you select the worst scheme in this market. That's why there is nothing to fear and it's almost impossible, that you will lose in the long run. But if you have selected a good scheme, then your returns can be as high as 22-23%. That means, your average return can be between 10%. Worst case20%-22%. In the best case, it is much better than gold, property, or any other asset class. That's why you cannot afford to avoid Mutual Funds, because of this return potential.

Investing in mutual funds is very important. You will get better returns. So now, that your fear is gone let's talk about, what the mutual funds concept is and how it works? and with that can you invest in funds?

This blog is designed for beginners who want to know all the basic things, about mutual funds.

What are Mutual Funds?

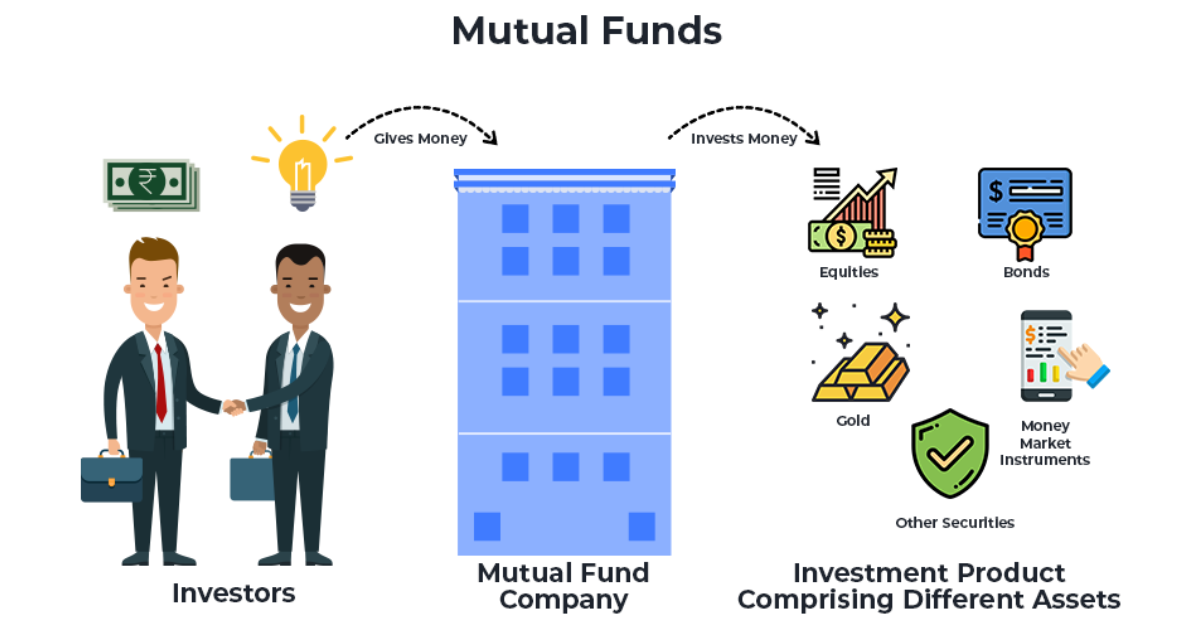

Many people think, that mutual funds are the only way of investing in the share market. But with mutual funds, you can invest in gold, if you want, you can invest in real estate, you can invest in debt funds or you can invest in the share market or equity. You can invest in all four through mutual funds.

But mostly when it comes to the risk and return of mutual funds, the risk is high. It can be a little volatile, but returns are high. Maybe it can go a little up and down. All of this is in the equities context. This means the money, that mutual funds invest In the share market, in that context. To understand the mutual fund properly, the important thing is to know the share market.

Basics of the Share Market

There are three ways to invest in the share market.

First is, what shares are good and what are bad. And pick your shares for yourself. The advantage is, that you are not dependent on anyone. You're not paying any fees to anyone. The disadvantage is that it's time-consuming. It takes time to find good shares and undervalued shares. You don't have the knowledge to do that and it takes time to get the knowledge.

The second is, that you take the help of a research analyst or an investment advisor to take the help of an expert. The advantage here is, you don't have to give time, just dependent on them. The disadvantage is, that you have to make regular transactions. An advisor can tell you to buy this share, don't buy this. They will take their fees, but you have to do that buying and selling regularly.

The third way is mutual funds. Through a mutual fund, you can also invest money in the share market. Where you don't have to track regularly, fees are low, and you don't need to have stock-picking knowledge. You just have to select a good fund.

Now you know the basic purpose of mutual funds, that purpose is, for equity funds to give you exposure to the share market and to invest in the share market. Now, let's find out how it works. If you want to invest Rs-20,000 and you want to invest yourself or through an advisor. Advisor has told you, you can invest in MRF, Page Industries, or Eicher Motors shares. So that one share is above Rs-20,000, and you only can spend Rs-20,000. So you can't buy it, and that's a big problem. By going directly or through an advisor. But, what a mutual fund does is, take Rs-500 from you and Rs-500 from someone else, like that it will take Rs-500 from 100 other people it has Rs-50,000, and bought 2 shares of Page Industries.

So, if you were alone and invested Rs-500 then you couldn't have bought Page Industries shares. Now, as there are 100 of you, so together you bought 2 shares of Page Industries. Now, people are 100, but share 2, so how will they be divided? So Instead, mutual funds buy 2 shares and give you mutual funds units. Then 2 shares were bought, Rs-25,000 each so a total of Rs-50,000 is invested. 100 people have invested, so the mutual fund will give you 500 units. So all of you have collectively become holders of those 2 shares. So mutual funds allow you to invest in more companies for less money which you cannot do by direct investing.

Now, how do mutual funds do this? They build a fund management company, called AMC. That company launches funds and asks people for money. Like, we have launched a multicap fund and will do all kinds of medium and small investing. We have this expert, who will manage your money. This is their track record. We assure you that we will give you good returns, so come and give us your money. So, people like you like me, who will be interested, some Rs-500, some Rs-1000, Rs-10,000, Rs-20,000, and Rs-50,000 will give that AMC Asset Management Company funds. , all the gathered money will be called AUM, which is the Asset Under Management, total money. So suppose that this time Rs-2000 were taken and 50 people were there. Now Rs-1,00,000 have come. Now, AMC will appoint a funds manager who is an expert in picking shares. Now, he will make a strategy, for where to invest this Rs-1,00,000, Rs-20,000 in one share, Rs-5000 in another, and will invest that Rs-1,00,000 in share market. And will give you that mutual funds scheme units. Which you can sell anytime. Money will be sent to your account in 2 days. So this is the basic concept of the mutual fund.

Mutual means shared, like sometimes we say in shared rooms at hostels. A mutual fund is such a fund, where everyone's money is shared and a pool is being made. And, they are buying shares with that pool money. It's the simple concept of mutual funds. Now, let's see the advantages and disadvantages. The first advantage is more diversification with little money. If you want to spend Rs 2000-4000, then you cannot buy many shares. But in mutual funds, where everyone's money is pulled, and is invested in many companies, so your Rs-2000 can be invested in many companies, which you cannot do directly. With little money, you'll get more company exposure and get more diversification. An expert in managing your money. So if you tell an expert yourself to invest Rs-2000 then the expert will say, you have only Rs-2000, my fees are more than Rs-2000, so how can I give you advice.

But in mutual funds, where thousands of people like you come together and pay their fees then you get the expertise of a fund manager at a very cheap price. And, the cheap price, is called Expense Ratio. What happens is, if you are investing Rs-100 in mutual funds so for that Rs-100 roughly, depending on the scheme Rs-98 to Rs-99 is spent on that scheme and the company takes Rs-1 or Rs-2, for the expert salary. This is called the Expense Ratio. The lesser the expense ratio, the better which shows that your fund manager is charging the least fees. Third, if you invested money once, then mutual funds will keep on buying and selling shares. So you do not need to do transactions again and again. So you can live your life comfortably, without thinking about which share to buy and which one to sell. Fourth, you must have heard about SIP. Once you set the mandate in the bank every month, from your account Rs-1000, Rs-2000, Rs-5000, as much as you want, Keep deducting it and keep investing in the scheme that every month, you do not have to do anything manually.

You have put the SIP, it keeps investing what you save in salary and automatically will be deducted from the bank. You can stop SIP whenever you want and can decrease or increase it whenever you want. It's all at no charge. Absolutely flexible. Think that, If the SIP is running but there is no money in the account the SIP will be bounced. Many people fear it, but there is nothing to fear. It's not like check bounce, Rs-5 to Rs-10 are taken as bank mandate charges, and no other loss is there. So until now, I have told all the good things about mutual funds. So, are mutual funds the best and there's no flaw. It doesn't happen with anything and I must tell you the disadvantages and wrong things.

First is, the greed of that mutual fund company. Many mutual fund companies are there, that want more and more money to come to their schemes. They will do a lot of marketing, hire more people, and just want a lot of money. Because of the amount invested in that company, the company will earn 1%-2% of it. So performance is good or bad, that doesn't directly affect them, how much money is coming and how many people are investing they will earn 1%-2% of it. So sometimes the simple focus of some companies is just marketing money not managing it.

Second, and this is a big flaw. It's not in the hands of the mutual fund's manager, when to invest in shares and when to take them out. It's in your hands. If you give them money, they will invest. If you want redemption, saying you don't want to continue, give my money back. Then mutual funds manager have to sell the shares and give your money back. So sometimes happens, when the market crashes and all the share prices are down and the shares are available cheaply. So the fund manager who is an expert, wants to invest in these cheap prices. But normal people panic, that the market is crashing and they have to get out so they apply for redemption and take back their funds. The fund manager, in compulsion, has to sell those shares, which he invested at a loss, and give you your money back. Where he wants to make more money so he can buy cheaply, but nothing happens by him saying or not saying. If the common man, at large would want to get out of the mutual funds then the fund's manager had to sell the shares and give you your money back you and that fund will both make a loss.

Third, the entire fund performance depends on the funds manager and research team. Sometimes, the research team wants to save their jobs. They don't buy such stocks, which can give more return but are risky. They don't want to take risks. So many fund managers, to save their jobs and reputations. Only invests in well-discovered and well-known stocks so returns are not as high and as you expected, the scheme underperforms. If the fund's manager wants and has a good idea in the small or large cap category, even then he cannot invest because the scheme's mandate and directions are restricted for mid-caps. For this reason, the performance sometimes suffers. This does not happen when you personally invest, in any stocks you like, big or small companies, you can invest. In mutual funds, sometimes mandates are restricted.

Now let's talk about the biggest use of mutual funds. Mutual funds should be used for your goal planning. Like, if you want to get your kids married, after 15 years, you need their education funds after 10 years, if your retirement is in 20 years, you can select mutual funds, according to these. Let's start with months, what month is it now? June, so June and July are usually college admission times. Your tension here now is fees money. If you start today, select one fund for kids' education each month, as you expected it. If you expect you to need Rs-15 lakhs, after 10 years, and from today, you start SIP in one fund. So you get the expected amount after 15 years. You can make one fund for kids' education, one fund for marriage, and one fund for your retirement. And besides that, you can take a fourth high-risk fund. If you want to go on a holiday or have a foreign location dream, this fund should be high risk, because it's a luxury, not a compulsion if you cannot go, then your life won't be ruined. So for this, take a fund that is a little risky.

You may make a lot of money and go on a nice vacation, or you make a little less money because it was a high-risk fund so you didn't get good returns, made some losses, and went on a domestic vacation. But this is such a goal, where you can take a little risk. You can't take a risk on a kid's education, should be a safe fund can't take a risk on a kid's marriage, should be a safe fund for vacation, you can take it. So in this case, it's for an example, not investment advice. According to me, if you planning this then you can take two large-cap funds, and one mid or multi-cap fund for vacation. So like this, you can design your portfolio, according to your goal.

I say it again, this goal planning is just for example. Your exact goal is based on your need, how much money you want, how many years and how important is that money, depending on all those factors. Despite that, how many dependents are there? Is there any other earning member? Are the number of dependents gonna increase? There are many factors. So you have to make a good portfolio, according to these factors.