Save Tax, Save Your Hard-Earned Money

Investing in ELSS Mutual Funds is one of the best and most popular ways to save on Tax.

ELSS Fund an Equity-Linked Saving Scheme

We all want to save our hard-earned money and invest in various traditional tax-saving instruments under Section 80C, like Bank FD, NSC, PPF, etc., to save Tax. Investing in ELSS Mutual Funds is one of the best and most popular ways to save on Tax.

What is ELSS?

Equity Linked Saving Scheme (ELSS) is a diversified equity mutual fund qualified for exemption of up to Rs 1,50,000 under Section 80C of the Income Tax Act.

The investor gets the benefit of Capital Appreciation with Minimum Tax.

▶ An ELSS mutual fund scheme must hold at least 65% o its total portfolio in equity stocks.

▶ If you invest in ELSS through SIP, each SIP installment will be locked in for three years from the investment date.

▶ Returns of the scheme are dependent on the performance of the securities invested

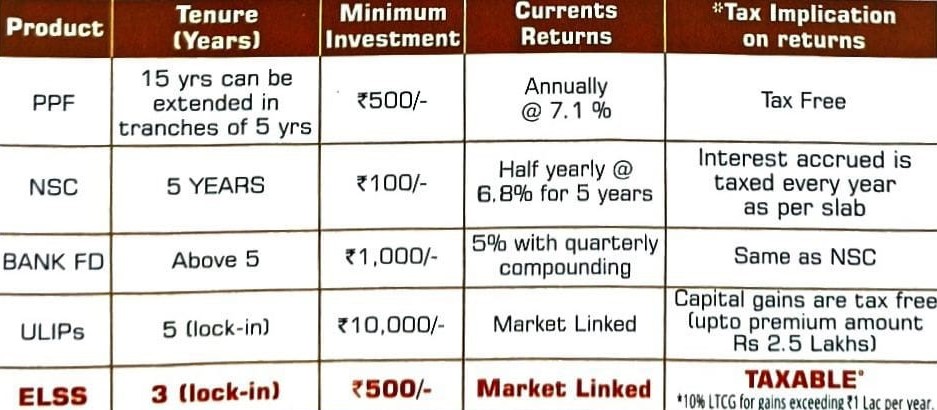

By investing in ELSS, u/s 80C, you can save up to Rs 46,800/

For FY 2022-23, for an individual resident falling in the highest Tax bracket+

(assuming no surcharge is applicable)

The exemption is available only if you have opted for the old tax regime.

Why Should You Invest in a ELSS fund?

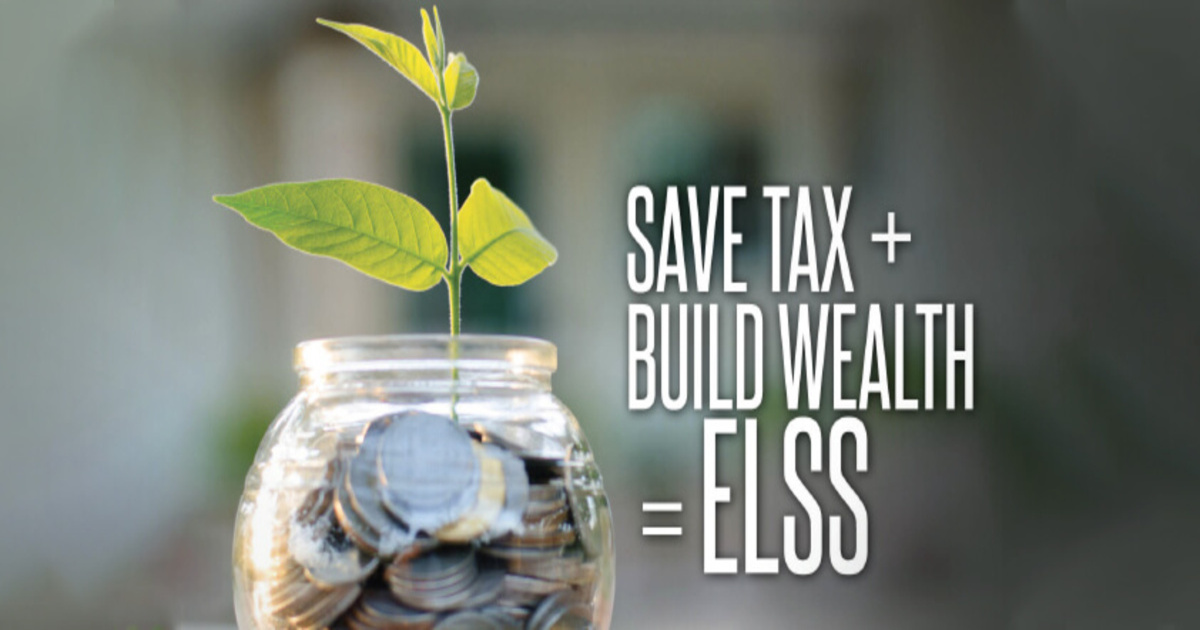

▶ ELSS has the minimum lock-in period of three years among all tax-saving instruments

▶The long-term capital appreciation is taxed at a lower income tax rate in the hands of the investor, while in the case of other tax saving instruments like Bank FD, or NSC, etc., the interest at a higher rate is taxable. Though interest earned on PPF is tax-free, the tenure of PPF is 15 years compared to 3 years for ELSS.

▶ Excellent opportunity to create wealth in growing Indian stock markets

▶ You can opt for the SIP option in ELSS if you don't want to invest a massive amount in one go. It will also bring discipline to investing.

Comparison

Let's compare the following Tax saving options u/s 80C...

PERFORMANCE

ELSS is the smart way to save Tax and build wealth. If you had invested Rs 1.5 Lacs each year in an ELSS scheme From March 2003 to March 2022, it would be worth Rs 1.91 Crores today.

At 16.8% return as on 31st March 2022 (Average of 6 ELSS Funds)

Amount in Rs based on Tax Slab of old tax regime for FY 2022-2023

Assuming an investment of Rs1,50,000 in ELSS in this financial year.

Please see the income tax rules for details.