Stable Returns On Your Investment

Investors want to maximize returns from their investments but refrain from a venture into Equity because of the risk involved.

Balanced Fund

Investors want to maximize returns from their investments but refrain from a venture into Equity because of the risk involved. And hence, many Equity investors eventually land up becoming Debt investors. Balanced Fund is a solution to such investors' needs.

What is a Balanced Fund?

Balanced Fund is a category of hybrid mutual funds that invests in a combination of Debt and Equity, intending to provide capital appreciation by investing in the equity asset class and contain risk by investing in debt securities.

► A Balanced Fund invests 65% or more of its portfolio in Equity and 35% or less in Debt.

► Balanced Funds are designed to offer superior long-term returns generated from common stocks and protect capital through investment in Debt.

Why Should You Invest in a Balanced Fund?

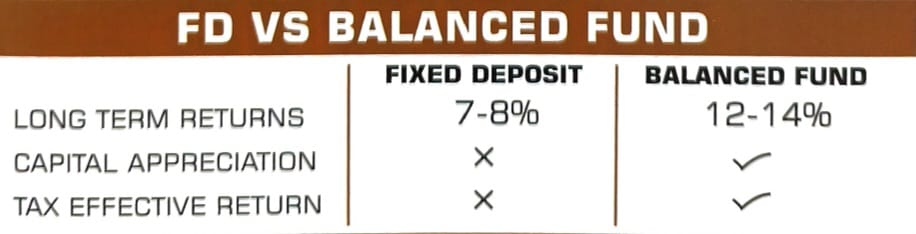

► Tax Benefits: Since the Balanced Fund invests more than 65% of its portfolio in Equity, it is treated as an equity fund for taxation purposes. Capital appreciation after holding the investment for more than a year is considered a long-term capital gain and is tax-free in the hands of the investor.

► Less Volatile: Including a significant portion of Debt in the portfolio protects your investment from downturns.

► Returns: Balanced Funds rise with a rise in markets; hence, the investor gets an opportunity to earn in growing markets.

► Diversification: A balanced fund helps the investor diversify his money between Debt and Equity through a single investment.

Investing in a balanced fund is the best bet for a first-time investor. A new investor's return and risk appetite differ from a mature investor's. Balanced funds satiate the desire to grow by investing in stocks and limit the risk by investing in Debt.

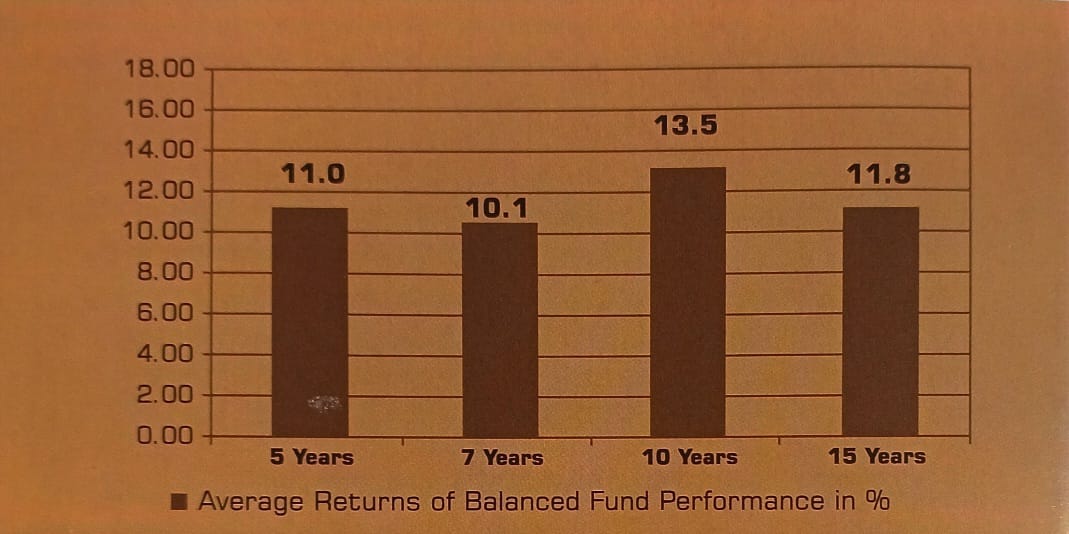

Performance